can you work part time on temporary disability

The benefits you may receive from the SSA would be temporary then too lasting only as long as you meet the SSAs medical eligibility requirements. If you earn more than this amount called the substantial gainful activity SGA limit Social Security assumes you can do a substantial amount of work and you wont be eligible for disability.

.jpg)

Division Of Temporary Disability And Family Leave Insurance Maternity Coverage

However the full answer to this question depends on how much you earn and what kind of disability benefits you are receiving Social Security disability benefits or SSI benefits.

. The Social Security Administration even allows for trial work periods that let you work for a time while receiving your Social Security benefits typically nine months in a rolling 60-month period. Social Security Disability Benefits. These weeks can be claimed any time you are medically certified as functionally unable to perform your work duties during your benefit year and you are out of work for a minimum of 7 consecutive days.

The MRC is part of the solution to this process and can help you reach your goal of financial independence. When you qualify for Social Security disability benefits you typically can work as long as your earnings are below a certain financial threshold and youre working part-time. Work while recovering and your employer offers you this type of work you receive temporary partial disability TPD payments if your wages while recovering are below a maximum limit set by law.

The law requires that you file your claim within 90 days from the date you were disabled. How much are TD benefits. Eligible employees who are unable to work due to illness injury or pregnancy can get a cash benefit to partially replace their lost wages.

If Social Security decides you can do your part-time past relevant work you. Payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind. Temporary partial disability amounts are calculated on the wages that you are losing from the hours you are not working.

You may also be eligible if your doctor restricts the type of work you can do and your employer does not provide full-time work she only has part-time work that fits into your restrictions. However you cant receive more. Working part-time will earn you less disability benefits than if you had worked full-time since the benefit amount is based on your earnings.

Ad Social Security Disability Insurance Stops If You Earn More Than Certain Monthly Limits. So if you have part-time work that counts as past relevant work the usual principle if you can only work less than 40 hours a week you should get disability benefits does not apply. If you can work part-time you will receive temporary partial disability.

If you file your claim after 90 days you may lose part of your benefits unless good cause can be shown. First you must have a non-work related illness or injury that keeps you from working and be under medical care for treatment of the disabling condition. TPD payments are also made if you can return to your work but only for limited hours or limited duties at a lower wage.

This formula determines your average indexed monthly earnings AIME. If you are working part-time intermittent reduced hours or receiving reduced wages you may still qualify for Disability Insurance DI or Paid Family Leave PFL benefits. In most cases you will continue to receive benefits as long as you have a disability.

Rhode Island has a state-run program that provides temporary disability insurance TDI for employees paid for by a special tax withheld from employees pay. 17 31 Minimum and maximum temporary disability amount. The most you are allowed to collect is an amount equal to 30 full weeks.

The TDI program is operated by the Rhode Island Department of Labor and Training. The SSA uses a complex formula to figure out your SSD benefit amount. You can work part time while you apply for Social Security disability benefits as long as your earnings dont exceed a certain amount set by Social Security each year.

Are You Taking Part in One of Social Securitys Work Incentives Programs. If you have a medical condition that will put you off work for 12 months or longer but is expected to improve eventually then you have a temporary disability. Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits.

Each state has its own eligibility criteria and rules for benefits. Most disability plans permit a disabled person to work either part or full time as long as the job does not aggravate his condition and he remains within income limitations stipulated in the plan. For example in California you can work part-time and still receive partial benefits as long as youre suffering a loss of income and meet the other eligibility guidelines.

Second you must have worked for at least 20 calendar weeks earning at least 145 per week for a covered New Jersey employer. If you file your claim more than 26 weeks after your disability you. However there are certain circumstances that may change your continuing eligibility for disability benefits.

For example your health may improve or you might go back to work. If you have already been awarded Social Security disability benefits it is possible to work part-time and not lose your disability benefits. We suggest you apply for benefits and we will determine if you are eligible.

As a general rule TD benefits are two-thirds of the gross pre-tax wages you lose while youre recovering from a job injury. The Massachusetts Rehabilitation Commission MRC can help you understand how working may affect your benefits. To qualify for Temporary Disability Insurance in 2021 you must have worked 20 weeks earning at least 220 weekly or have earned a combined total of 11000 in those four quarters the base year.

Part-timeIntermittentReduced Work Schedule. Understanding your disability benefits can be complicated but you can work and still receive benefits. Whether youre already receiving benefits or are just starting the social security disability application process you may be wondering if working part-time on disability is an optionEven if you qualify for the maximum monthly disability benefits amount you may still be looking at a significant decrease in your monthly incomeThe ability to hold down a part-time.

The first 4 quarters of that time frame is called the base year. In New Jersey its considered fraud if you work and collect Temporary Disability Insurance.

Here Some Writing Tips And Examples Of Human Resources Resume Human Resources Resume Human Resources Resume Examples

2019 State Mandated Short Term Disability Contributions And Benefits Mercer

Can You Work While On Short Term Disability

Division Of Temporary Disability And Family Leave Insurance Information For Employers

The Difference Between Short Term Disability And Fmla Patriot Software Medical Social Work Disability Human Resources Career

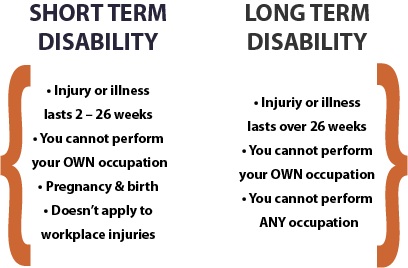

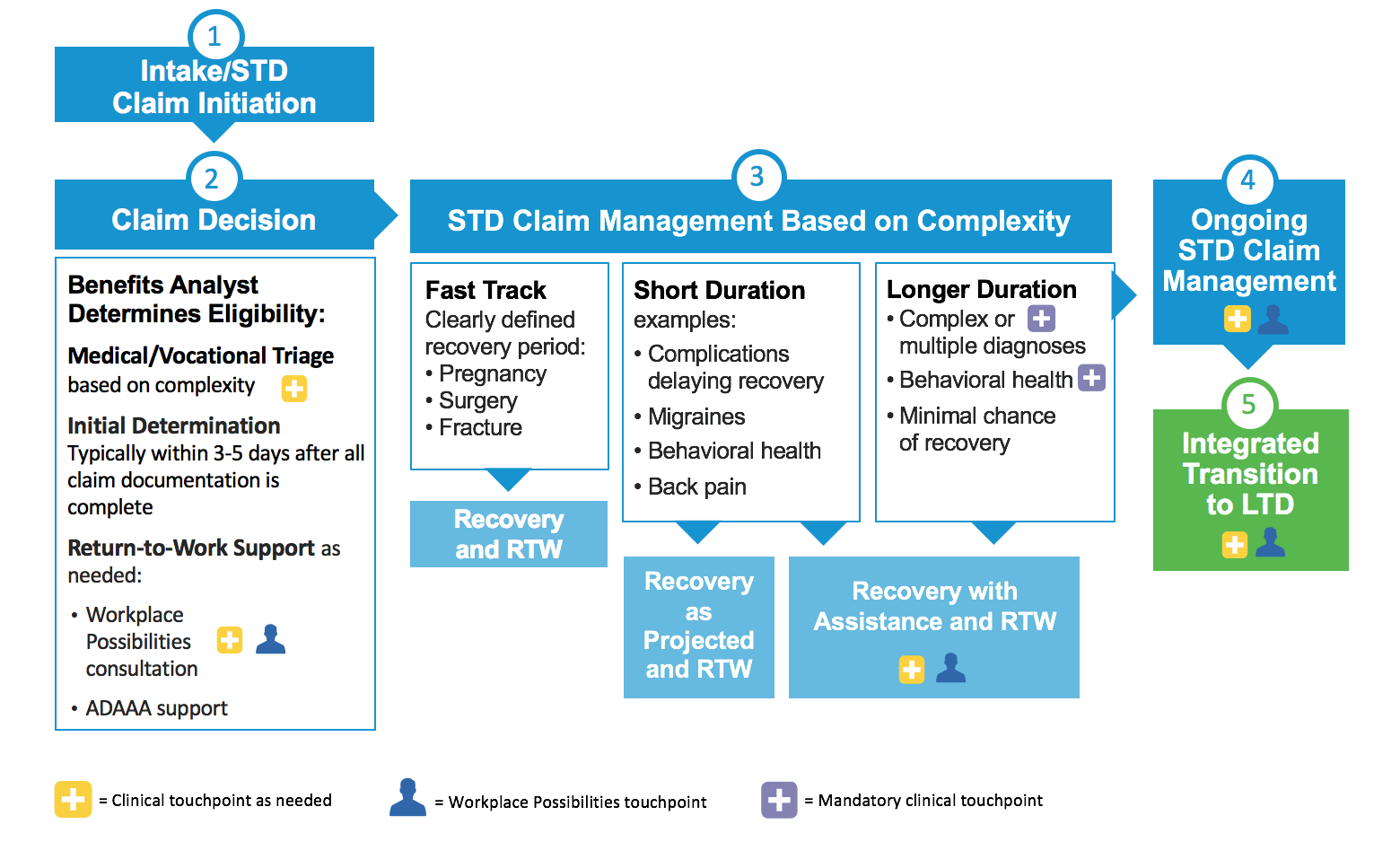

Short Term Disability The Standard

Can You Work While On Short Term Disability